The Australian share market is headed for a weak start after US stocks fell in choppy trading as investors assessed the Federal Reserve’s interest rate stance and a batch of soft earnings early in the financial reporting season.

Travelers tumbled on Wednesday as one of the biggest drags on the S&P 500 and largest on the Dow Industrials after the insurance giant missed Wall Street expectations for first-quarter profit.

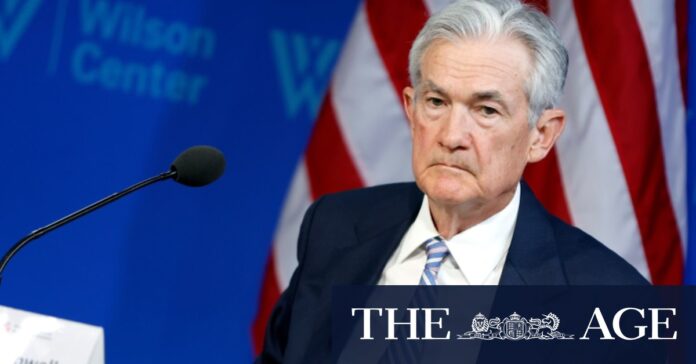

Jerome Powell backed away from providing guidance on when rates may be cut, saying instead that monetary policy needs to be restrictive for longer.Credit: Bloomberg

Also weighing on the benchmark S&P index after quarterly results were Prologis, with the warehouse-focused real estate investment trust dropping, and Abbott Laboratories, which fell after topping quarterly estimates but disappointing on its annual forecast.

After a rally in the last two months of 2023 that extended into the first quarter, equities have struggled with the S&P 500 registering its fourth straight session of declines. The index is on pace for its third straight weekly loss as investors have dialled back expectations for the timing and size of the Fed’s rate cuts.

On Tuesday, US central bank officials including Fed chair Jerome Powell backed away from providing guidance on when rates may be cut, saying instead that monetary policy needs to be restrictive for longer.

“The markets are dealing with a couple things – inflation is hotter than most expect, rate cut expectations are coming down and we’ve had a ramp higher in geopolitical tensions, particularly out of the Middle East,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial in Troy, Michigan.

“It’s just an excuse for traders to kind of move to the sidelines and markets to kind of take a breath after a really, really strong five months of gains.”

According to preliminary data, the S&P 500 lost 29.80 points, or 0.59 per cent, to end at 5,021.61 points, while the Nasdaq Composite lost 183.22 points, or 1.15 per cent, to 15,682.03. The Dow Jones Industrial Average fell 59.19 points, or 0.16 per cent, to 37,739.78.

The four-session S&P 500 sell-off is the longest in just over four months, matching a four-day run of declines ended on January 4.