[ad_1]

ECONOMYNEXT – The outstanding achievement of inflationist macro-economists in Sri Lanka and elsewehere is their ability to elect a new government, usually socialists or nationalists if liberals were in power, after driving countries into currency crises or asset bubbles after cutting rates for ‘growth’.

Stabilization programs, despite greater inflation and more hardships being stopped, provide fertile ground for fringe elements to come to power even as economies start to recover.

No liberal government, with free trading aspirations, can now survive in a country where forex shortages are created by spurious economic doctrines founded on statistics, backed by the International Monetary Fund more often than not.

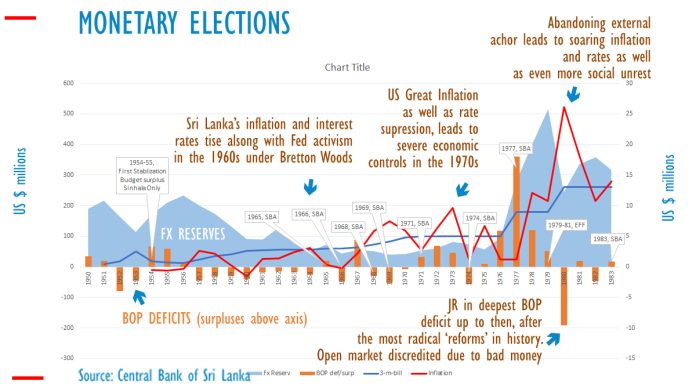

Sri Lanka’s post-independence currency troubles emerged soon after the central bank was set up in 1950.

At the time Fed was firing a commodity bubble, by purchasing Liberty bonds (in what would now be called yield curve targeting) pushing up Sri Lanka’s export prices until 1951.

At the time the Sri Lanka’s currency board had just been abolished and 3-month T-bills were 0.4 percent according to central bank data.

The Fed tightened in 1951, some export commodity prices fell, but rice prices rose requiring more subsidies from the budget.

Stabilization Programs and Illiberalism

Sri Lanka ran BOP deficits in 1952 and 1953 as the central bank printed money. Reserves fell from 216 million US dollars to 114.3 million by year end 1953.

Then 3-month bills were pushed up to 2.48 percent. Attempts were made to cut food rations. Food rations had started during the Second World War as the Bank of England lifted convertibility (floated in today’s terminology) and ran un-anchored policy printing money.

Sterling monetary instability also worsened after World War II, with Keynes driving British economic policy and Sri Lanka also had some exchange controls dating back from British policy, though a currency board regime does not really need them.

There was a leftist hartal in 1953.

In 1954, Sri Lanka’s politicians acted decisively and pushed the budget into surplus in what would be the country’s first stabilization program without IMF help with fx reserves down to 114.3 million dollars.

Growth fell, inflation also fell, but in the slowdown the nationalists started to peddle their wares.

The Sinhala Only Act was an election issue. The Sinhala only by nationalists upset the Tamil community.

When nationalists come, or leftists come, policies reverse, as liberal economic policies of free trade and private enterprise as well as small government and fiscal prudence are discredited.

German Nazism after Reichsbank/Fed Excesses

Rewind to 1931.

Much the same happened in Germany, during the administration of Chancellor Heinrich Brunings, where a stabilization program helped bring Hitler to power.

The Fed had as the time already triggered the Great Depression by inventing the policy rate (about 1920) and open market operations (in 1923) in the previous decade.

The usual socialist messing up of the economy, expropriation, coupled with the global depression leads to a belief that a ‘strong man’ can also solve the problem, economist Friedrich Hayek later explained.

In Germany the Social democrats (Marxists essentially) were ruling at the time, and with their policies discredited, nationalists under Hitler peddled their ideology easily and came to power, targeting the Jewish minority.

West Germany Stands Out as Central Bankers Win Elsewhere

By the end of World War II, with Germany in shambles, nationalists were defeated by outside forces and liberals came back with a hard money and stability doctrine not policy rate (money printing) driven growth.

They closed the Reichsbank, set up the Deutsche Mark under full control of the politicians, in the Austrian-Ordoliberal tradition, established free trade and full free market competition under a full liberal democracy. There was not an inflationist macro-economist in sight.

The Deutsche Bank as a formal institution was established much later.

West Germany’s Ordoliberals were so successful that the Social Democrats were relegated to the political backwoods until shortly before the break-up of the Bretton woods, unlike in Sri Lanka who went from strength to strength.

In 1959, The SPD officially abandoned its Marxism of expropriation and anti-capitalism under its Godesberg Program as the economy boomed and support for a strong currency and private sector grew gaining strong public support.

But the UK, the country that defeated Germany, remained mired in Cambridge economics, Sterling crises and IMF programs till Thatcher came.

The US was only slightly better.

Economics was under siege from the so-called Saltwater universities with a virulent form of Post-Keynesianism, coupled with toxic statistics, displacing classical economic principles.

Paul Samuelson, of MIT was a key driver of mindless econometrics in what could now be called data driven monetary policy.

Monetary policy deteriorated in the Fed with macro-economics coming to the fore with lean-against-the-wind policy, with the ‘wind’ also being originally fanned by the Fed with rate cuts.

In Sri Lanka in 1961, the Bank of Ceylon was expropriated and the People’s Bank was set up.

In 1961 the Federal Republic of Germany appreciated its currency around the same time as the Fed invented central bank swaps to borrow from other central banks without going to the IMF after printing money and losing gold.

Sri Lanka where Anglophone qualified ‘development’ economists who were by now pushing import substitution after severely depleting reserves, started going to the IMF from 1965.

J R Fails to Defeat Macro-economists

J R Jayawardene, the Finance Minister who originally created a central bank 1950 and made the country a member of the IMF the day after, brought B R Shenoy – probably the greatest classical economist produced in South Asia – to help in 1966.

Shenoy advises the country not to print money and float the currency, and avoid periodic devaluations and saying the calculations about equilibriums exchange rates which had by then emerged with the expansion of econometrics are suspect.

This is advanced thinking as the Fed has not floated yet.

Macro-economists in Ceylon predictably ignore his advice and instead print money for rural credit and start multiple exchange rates, Latin America style amid rising central bank activism.

In 1969 with reserves severely down, an import control law was brought into Sri Lanka, discrediting Dudley Senanayake’s free trade plans as central bankers won the day yet again.

In 1969 as the Fed fired global inflation, Germany’s Social Democrats were able to form a coalition government in Germany for the first time since they helped bring Hitler to power.

In 1971 as oil, food commodities and gold prices soars, Nixon closes the gold window, float the dollar and imposes import tax surges (Nixon shock).

Nixon is impeached later.

As the Bretton Woods and the US dollar collapsed, Sri Lanka closed the economy completely in the 1970s going much further than Nixon.

Econometric Corruption Spreads

The collapse of the US dollar led to the Great Inflation of the 1970s as reserve currency countries struggled to find an anchor for floating exchange rates.

Statistical corruption of economic principles reaches a new high.

Academic inflationists, apparently with no knowledge of central bank operational frameworks, clutched at the latest statistical formula.

Blaming statistical formulae, imports and trade deficits are regurgitated from classical mercantilism to excuses for monetary instability that allowed macro-economists to escape accountability for inflationary suppression of rates.

Wage-spiral inflation, oil shock, gives a new life to ‘cost-push’ inflation.

Nominal effective exchange rates are made popular by Fred Hirsch and Use Higgins .

Leftist uprisings proliferate worldwide.

Econometricians then came up with real effective exchange rates as currencies collapse and inflation diverges widely in the 1970s and worsened in the 1980s.

Germany rejects the ideas and starts to target money supply and shifts to inflation later in 1970s.

The deep knowledge operational frameworks (OFs) of note issue banks that classical economists from Ricardo to Hume to Torrens had developed in the 19th century seems to have disappeared by then in the unusually effective brainwashing at Anglo-American universities.

In 1978, the IMF effectively ended external anchoring without a credible replacement domestic anchor, plunging many countries like Sri Lanka into a blackhole of monetary instability.

The exchange rate goes haywire, and inflation rockets.

As inflation goes up budgets go haywire as the state is unable to manage rising expenses.

The macro-economists artfully blame budget deficits for monetary instability (which is dumb in the first instance, since credit is credit whether its private or state), not inflationary central banking.

In the 1980s East Asia latches on to the dollar with currency boards (or currency+board+plus regimes where foreign reserves exceed reserve money), and imports the stability the US Fed achieves under Volcker and Greenspan which was called the Great Moderation.

These countries grew with both monetary and political stability and use the renewed free trade agenda of Western nations in the Great Moderation to grow their economies.

J R Jayewardena came to power on the back of trade and economic controls of the 1970s, driven by money printing as well as bad Fed policy involving the so-called ‘Great Inflation’.

In the belief that the ‘strong man’ can take the economy forward, an authoritarian constitution is enacted, in repeat of what happened in Germany after Weimar socialism.

Open Economic Reforms Discredited by Unanchored Money, REER

But the depreciation of the rupee led to a period of ‘Greater’ Inflation within Sri Lanka until 1995, even as the US, Europe and East Asia grew in the Great Moderation of low inflation, directly as a result of the IMF depriving the country of a credible monetary anchor.

Sri Lanka tries money supply targeting without a floating rate and fails. As the Fed tightened in 1980, Sri Lanka goes into the worst BOP deficit up to then of 191 million dollars. Latin America external defaults begin.

J R the ends up with severe social unrest and a second leftist uprising on top of the northern rebellion which turned into an intensified civil war after the 1983 nationalist riots. There was high inflation and stabilization program around the time as well.

JR brings the greatest classical economist of East Asia has produced, Singapore’s former finance minister Goh Keng Swee, as Sri Lanka is shunted into an IMF bailout within two years of the most radical economic reforms the country had ever seen.

Goh tells J R not to print money and not to depreciate the currency as Sri Lanka is similar to Singapore and is a trade dependent country.

Macro-economists ignore the advice. Instead, in 1985 macro-economists set up Regional Rural Development Bank linked to the central bank to give re-finance credit.

Jayewardene held on to power with electoral gimmicks and authoritarianism as the currency collapsed and inflation soared.

Import substitution again came to the fore, spreading to onions and potatoes.

Stabilization and Jan Bala Meheyuma

Fast forward to 2001.

Ranil Wickremesinghe came to power as Prime Minister on the back of the 1999/2000 currency crisis and IMF stand by arrangement, the ‘pariwasa government’, and the Jana Bala Meheyuma.

He completes the stand by and starts a new IMF program – not to restore stability, but a pure reform program, labelled Regain Sri Lanka with monetary stability already restored. The economy recovers strongly with a ceasefire also in place.

The JVP attacks him on fuel pricing as oil and fertilizer prices soar with Ben Berananke misleading Greenspan into printing money to target positive inflation in what was then called the ‘mother of all liquidity bubbles’.

The just-ended 2000 currency crisis has also seen Sri Lanka’s CPC borrowing from Iran to import oil amid forex shortages in a precursor to suppliers credits in the post-war flexible inflation targeting driven currency crises.

Though inflation is low, and the economy is in full recovery mode, Wickremesinghe is attacked by his political foes on a peace deal with the Tamil Tigers. When then-President Chandrika Kumaratunga takes over ministries while he is in the US, people flock to the road to support him as he lands in Katunayake.

Wickremesinghe sends them home empty handed and later he ends up without a government.

Because the Fed is targeting positive inflation using core inflation, ignoring the commodities, and hedonics and other tools that understates inflation amid a private sector productivity boom, a massive asset price cum commodity bubble is formed by 2008.

Amid a civil war and the Fed’s housing cum commodity bubble, Sri Lanka has another currency crisis with capital flights from rupee bonds, and goes to the IMF in 2008.

In the next election Mahinda Rajapaksa wins, despite the IMF stabilization program with a war victory in an unusual first for Sri Lanka on nationalist considerations.

The rupee is allowed to re-appreciate from 120 to 113.

But in 2012 rate cuts with printed money triggered a currency crisis within the IMF program triggering another stabilization program. The rupee falls to 130 to the US dollar.

Ranil Defeated by Potential Output Targeting

Fast forward a little to 2015.

Wickremesinghe came back to power in 2015, just as the economy is recovering very strongly from a currency crisis triggered by central bank rate cuts in 2011/2012.

The IMF then teaches Sri Lanka to calculate potential output. The central bank prints money to cut rates in 2015, amid spending bout for the 100-day program, and triggers another crisis.

In this IMF program, there is no cost cutting. Instead, ‘revenue based fiscal consolidation’, a type of IMF backed estate expansion which rejects cutting government spendings is in operation.

Spending is ok, but deficits are supposed to be cut by tax hikes only not cutting expenses (spending-based consolidation), putting the entire burden of adjustments on private citizens.

Sri Lanka then starts to print money by printing large volumes of money to narrowly target the call money rate in another deterioration of the central bank’s operating framework. The rupee falls from 130 to 152.

There is a stabilization program which discredits Wickremesinghe’s administration and taxes are hiked.

Hot on the heels of the 2016 crisis, another currency crisis is triggered in 2018 despite tax hikes on revenue based fiscal consolidation, due to targeting potential output with printed money as inflation falls.

Yield curve targeting, Liberty Bonds style also emerges in the period.

Instead of borrowing from Iran, the petroleum utility gets suppliers credit after potential output targeting and then converts them into state bank loans. CPC runs losses despite market pricing oil. The borrowings later add to national debt after a default.

The rupee falls to 182 and another stabilization program is put in motion.

Wickremesinghe’s goose is cooked and his economic policies are discredited.

Nationalists Rise on Stabilization Program

Nationalists have a field day on the stabilization program and revenue based fiscal consolidation in 2018. This time Muslims are targeted.

Hitler blamed the jews for a ‘stab in the back’.

Muslims are blamed for sterilization pills. A prominent Buddhist monk calls for a Hitler to come to power.

Gotabaya Rajapaksa comes to power and takes oath in front of Ruwanwelisaya, a Buddhist dagoba, built by King Dutugamunu.

Macro-economists think tanks, who are advising descends on him like vultures and taxes are cut on top of rate cuts saying there was a ‘persistent output gap’ in the most extreme macro-economic policy seen in the island.

Covid comes. As the economy recovers from covid, the printed money triggers forex shortages despite import controls. All kinds of shortages appear.

People come to the streets dwarfing the 1953 hartal and the Jana Bala Meheyuma.

Gotabaya Rajapaksa’s goose is cooked.

Poor people starve. Poverty rockets, Latin America style, as the rupee collapses. Outmigration picks up, Latin America style.

Another Stabilization Program

After the Rajapaksa’s ouster amid Wickremesinghe comes to power again and goes about fixing the country, helped by newly appointed central bank Governor Nandala Weerasinghe who markets prices interest rates. Longer term yield go far above the policy rate.

Unusually, going against the usual IMF advice to destroy the currency, to destroy savings, to destroy salaries and trigger more social unrest, he is allowing the currency to appreciate amid deflationary policy.

Because nationalist elements are supporting President Wickremesinghe, nationalism is muted in the current stabilization program.

Instead of Muslims, nationalist elements tried to use archaeology against Wickremesinghe.

However, the strategy is less successful than in the past since it was a nationalist-backed administration that created the crisis in the first place. It seems also that Wickremesinghe knows more history than the nationalists.

Sri Lanka has destroyed the currency as well as domestic capital since 1977, but has not become an export powerhouse like East Asian nations with monetary stability did, or services hubs like the Middle Eastern currency board style nations.

The rupee is now probably allowed to appreciate on some econometric formula, not with any belief in sound money.

Wickremesinghe has been duped into legalizing potential output targeting through a deadly monetary law and giving ‘independence’ to macro-economists who believe in 7 percent inflation and central bank swaps.

Mercantilists and macro-economist who earlier spread the narrative of imports, trade deficits, domestic production and real effective exchange rates to escape accountability now.

They now blame the lack of reforms for monetary instability and repeated trips to the IMF, conveniently forgetting that the 1980 onwards IMF programs came with the most radical reforms ever.

Each time leftists and nationalists are elected, by a desperate public who are looking here and there for saviours, liberal policies are rolled back and post-independent policies that gripped the nation from 1956 to 1977 are brought back.

Monetary instability involving dual anchor conflicts (a reserve collecting central bank trying floating rate OFs) is unchanging, and continues under different labels.

Corruption is also blamed for the crisis. Exporters are themselves blamed for forex shortages and the currency crisis by some in another strange twist, which however is rejected by the central bank.

Who will IMF and the Central Bank Elect in the Upcoming Elections?

In summary history shows that a stabilization program, which comes after rate cuts for growth, is when fringe elements are mostly like to be elected.

The JVP, a leftist party which believes in expanding the state (in line IMF’s progressive Saltwaterist revenue based fiscal consolidation) is now doing well on social media.

Some of the younger demographics that supported Gotabaya Rajapaksa after the 2016 and 2018 stabilization programs are active in social media hoping to find salvation in the JVP.

In the confusion, a widespread belief that the currency crisis and default was caused by corruption, and not aggressive macro-economic policy, is being strengthened.

The belief also helps the JVP, which has not been in power, and is projecting a clean image, regardless of its economic credentials and violent past.

That the 1970s problems came from Laski’s Marxist ideas on top of monetary instability from the central bank is not known.

In any case it was before the time of current generation of young voters.

In rare occasions, stabilization programs have helped build liberal democracies in the past, when nationalists and socialists were responsible for the crises.

Germany after WWII when the Social Democrats were confined to the backwoods for three decades and Korea in 1987 are key examples.

Korea’s Great Peoples’ Struggle which made the country a liberal democracy, better than Japan, came on the back of stabilization and the first currency appreciation in the history of its central bank under its previous authoritative administration.

Springtime of the Peoples

The 1847-1848 Commercial Crisis or the 1847 Panic in Britain also did not lead to nationalism but to the enhancement of liberal ideas sweeping the region, with most countries under monarchs.

The 1847-1848 saw widespread crises in the gold area, not just the UK and Ceylon. It was also called the ‘Revolutions of 1848’ or the ‘Springtime of the People’.

In the ensuing crises was mostly a liberal democratic struggle that led to the end of monarchies, freedom of the press in several dozen European nations.

As commodity prices deflated and coffee prices collapsed, many plantations in Ceylon went bust and Torrington had to put new direct taxes on the people, IMF style.

The 1848 ‘Matale Rebellion’ was seen in Sri Lanka.

This is why the IMF’s progressive taxation that has caused so many problems for the people and made the reformist government unpopular and should be a warning to the ruling class.

Wealth taxes are also on the horizon, in further depletion of wealth and savings for investment for the future.

Politicians on both sides of the isle, who have socialist tendencies, like direct taxes and only criticize VAT, which is a superior tax.

But people feel income tax, where money is taken in big chunks, before a voluntary transaction is made.

The IMF’s planned wealth tax is a type of expropriation where people who have invested their savings and built houses are punished even when there is no cash flow and are also likely to turn people away from reformist leaders.

The wealth tax, like the progressive taxation and revenue based fiscal consolation, is in line with old communist ideas, which is coming to Sri Lanka as the result of progressive Saltwaterism of the West.

There is no wealth tax in socialist Vietnam. European style wealth taxes have been resisted by Republicans in the US also country which already has inheritance taxes when people die. Wealth taxes especially on homes, are slammed as people, including older people, are still alive.

Progressive Saltwaterism and Unsound Money

Under IMF influence Sri Lanka now has US style inheritance taxes and personal income taxes, European style VAT and and Argentina style monetary policy under flexible inflation targeting with up to a 7 percent target.

A country can still survive socialist style big-government taxes with higher levels of unemployment, like in Europe, if monetary stability is provided.

Before the policy rate for economic intervention (macro-policy), devised in 1920s by the Fed, monetary crises were relatively rare, that is why the British were able to rule with only a few rebellions in Ceylon and elsewhere.

Sri Lanka’s central bank which has given coercive powers to a few bureaucrats to cut rates with printed money and create forex shortages, is a key reason for this country’s monetary as well as political instability.

Unlike in West Germany or UK under Thatcher (UK was IMF’s top client until Thatcher-Hayek-Walters), the current reforms will not bring any long term benefits.

As a result, all the reforms that are being done now will be so much water under the drain, as they have been for the last 72 years, since monetary stability will be denied to the people by the use of inflationary rate cuts.

Sri Lanka was a fully free trading, stable country in better shape than Singapore, when it gained independence with a currency board. There were hardly any economic controls to reform.

Singapore on the other was devasted under Japanese occupation and banana money, just like the rupee with potential output targeting.

In the final analysis, whoever comes to power may be academic, as the IMF has already denied a single anchor monetary regime to the country with the new central bank law and legitimized printing money for growth which devastated the country after the civil war ended.

In Latin America countries default repeatedly with 23 percent plus revenue to GDP and 5 percent budget deficits, due to rate cuts enforced with printed money under operational frameworks similar to Sri Lanka.

After the Second Amendment to its Articles Argentina is now IMF’s biggest client, not Keynes birthplace.

The undermining of Milei’s monetary plan, which would have stabilized the country, shows macro-economists and the IMF really rules Argentina.

Sri Lanka’s central bank has allowed the rupee to appreciate, giving immediate benefits to the people, in sharp contrast to earlier programs.

History Set to Repeat

It is however not stable or consistent sound money, but only a temporary gain from external anchoring with the domestic anchor (5 to 7 percent inflation target) not yet operative.

But flexible inflation targeting, and the flexible exchange rate is fundamentally flawed.

The benefits are coming now because external anchoring has supplanted the domestic 5 to 7 percent anchor. Inflation is now only 0.9 percent with currency appreciation from deflationary policy.

Unlike in East Asia, deflationary policy is not assured.

On the other hand, external instability is almost guaranteed under flexible inflation targeting, with a 5 or 7 percent inflation target, the latest spurious monetary doctrine peddled to hapless countries which then end up in default, where a reserve collecting central bank is urged to cut rates claiming historical inflation is low.

Not just future but current domestic credit is disregarded in flexible inflation targeting despite a reserve collecting central bank being operated.

With Sri Lanka having market access, a second default is likely as the money exchange conflicts re-emerge as the economy recovers.

Supposedly, since 1978 (after the IMF’s second Amendment when external defaults proliferated) 58 percent of defaulters defaulted again.

Meanwhile after a decade of quantitative easing, US government finances are shot, and the chickens are coming home to roost. Economic nationalism is on the rise in the US.

With Trump in the wings, fully fledged nationalism is also on the cards. The same is happening in Europe.

Sri Lanka will also have to cope with that.

Whether it is Governor Torrington in 1948 with the British Commercial Crisis or Ranil Wickemesinghe in 2019 or 2024 after the potential output targeting cum/flexible inflation targeting crises, destroying money and credit has powerful political consequences to those who try to fix the problem.

Even if 90 percent of the things are done right – as now – even this column will pick holes in some leftist aspects of IMF programs and warn about the inevitable consequence of deeply flawed monetary policy, confusing the public.

It is not about reforms or leaders. Sri Lanka’s politicians have been willing to take very hard decisions always to take the country out of crises. It is about bad unstable money that prevents the fruits of those decisions coming to the people in subsequent years.

[ad_2]

Source link