[ad_1]

ECONOMYNEXT – Sri Lanka is recovering from an economic crisis amid risks to exports from global slowdown and any derailment of an International Monetary Fund program could create high economic risks, the central bank said.

“A major factor that influences the economic outlook is the continuation of the IMF – Extended Fund Facility (EFF) arrangement and the progression of the envisaged structural reforms,” the central banks Monetary Policy Report issued in February said.

“Any disruption to this programme would create high economic costs to the country due to growth derailment, loss of confidence, and the protraction of negative investor sentiments.”

Sri Lanka has stabilized and economic activity is recovering the central bank said though growth would be subdued in the near term.

Sri Lanka went through the worst episode of monetary instability since the creation of the central bank in 2022, after aggressive macro-economic policy to target potential output (printing money for growth) under flexible inflation targeting.

Aggressive macro-economic policy gathered pace after the end of a 30-year civil war triggering back-to-back currency crises that reduced the growth trend to below the levels seen during the civil war, according to critics.

Sri Lanka’s recovery is also threatened by a possible global slowdown as the Federal Reserve also pulls back its own monetary excess that triggered the worst inflation seen in 40 years.

“Economic growth is expected to remain subdued in the short term but is expected to recover gradually towards its potential,” the report said.

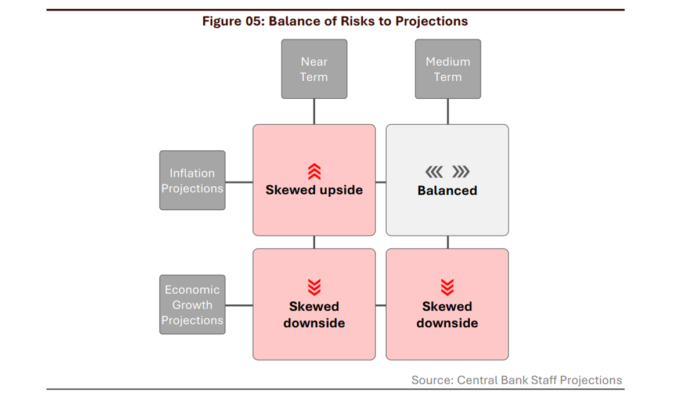

“Risks to real economic growth projections are skewed to the downside both in the near term as well as in the medium term, as economic activity is susceptible to adverse developments in the global front that affect export recovery…”

There would also be a loss in productivity due to outmigration of skilled labour and structural impediments to growth, the agency said.

The budget deficit may rise due to bank recapitalization.

Inflation would be around a targeted 5 percent path though there may be a spike due to tax hikes.

Sri Lanka’s central bank has over the past year conducted prudent monetary policy and also allowed the exchange rate to appreciate amid deflationary monetary policy, analysts say.

Sri Lanka in the recent past has triggered currency crises with inflationary open market operations targeting 5 percent inflation. (Colombo/Feb15/2024)

[ad_2]

Source link