[ad_1]

ECONOMYNEXT – Sri Lanka is not barred from giving investment incentives if they are not discretionary and are based on transparent rules, Thilan Wijesinghe, an investment banker who was a former Chairman of the Board of Investment said.

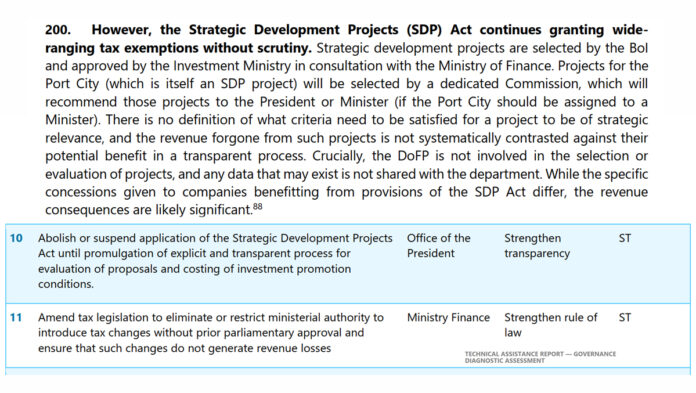

The International Monetary Fund has frowned on sweeping tax holidays running up to 20 to 25 years given under a Strategic Development Project (SDP) Act for undermining the revenue base and leaving the door open for corruption.

Related Sri Lanka logistics centre with China gets 15-year tax holiday

IMF senior mission chief Peter Breuer told reporters earlier this month that a recently gazetted tax incentive may not be approved by parliament.

“On tax concession, so there is a commitment in the program to grant, to not grant any more tax concessions,” Breuer said.

“Tax concessions are a missing component of tax revenues. So on the one hand you try to increase your tax collections, but on the other hand there are these tax concessions where people don’t have to pay taxes. And so it’s important not to continue with this practice.

“And we have been assured that that is in fact being followed. And although there have been proposals for tax concessions, including the one that I think you’re referring to, our understanding is that that’s not actually being approved and that is very important.

“I should also say that in the program there is also a commitment for enhanced transparency with respect to tax concessions and tax exemptions.”

Wijesinghe says an IMF diagnostic report shows that incentives can be given provided there are transparent rules.

“IMF has not shut the window on investment incentives,” he told a forum on economic freedom organised by Advocata Institute, a Colombo-based think tank and Canada’s Fraser Institute which compiles a global economic freedom index.

“The IMF is slapping us in the knuckles and saying, ‘Be more transparent in the way you formulate investment incentives. Frame regulations so that investment criteria is composed equally whether you are a local investor, a foreign investor, or a Fortune 500 company”,’ Wijesinghe said.

“Today, under the SDP Act, if I don’t like A versus B, you can give more incentives to A and not B. So where do we go from here?”

Wijesinghe said that the IMF diagnostic report pointed out that there is no definition on what criteria needs to be satisfied for a project to be of “strategic” relevance, under the SDP Act.

The report suggested that tax relief for investments under SDP be suspended until the “structures and processes are in place to evaluate the effectiveness of offered incentives, explicit criteria are to be established to evaluate the investment.”.

“And, it goes on to say that, prepare the necessary structures including data sharing protocol and legal documents and assign authority to the Department of Fiscal Policy,” he said.

“And therefore, to first suspend the SPD Act until explicit criteria are established to evaluate the investment incentives.”

Companies should pay income tax, but firms are chasing after the SDI to get relief from upfront taxes like import duties and para tariffs which push up the investment cost, he said.

When he was Chairman of the BOI and the Burau for Infrastructure Investment, and he helped bring investments to the South Asia Gateway Terminals, he objected to a long tax holiday but was overruled by the Treasury, he said.

More than income tax, the higher cost of setting up shop in Sri Lanka due import duties and para tariffs is a dis-incentive to investors and may hit the internal rate of return as much as 9 percent, he said.

However in recent years, investment has flowed into real estate which is a non-trade sector.

Some property projects however, including hotels (Mode 2 trade in services) and space that software companies rent, facilitate services exports (Mode 1 and also Mode 3), analysts say.

Sri Lanka has corporate tax at 30 percent after aggressive macro-economic policy involving rate and tax cuts made the country bankrupt, compared to lower rates in East Asian nations which have full or greater monetary stability than provided by Sri Lanka’s central bank, analysts have said.

Singapore, which operates an exchange rate based monetary policy, on currency board principles, has a corporate income tax rate of 17 percent.

https://taxsummaries.pwc.com/vietnam/corporate/taxes-on-corporate-income

Vietnam, a poster child in Sri Lanka, has a 20 percent rate.

Vietnam has pledged to maintain a minimum corporate tax of 15 percent for large foreign invested companies from January 2024 under the ‘Yellen tax’ promoted by the OECD.

Neighboring Cambodia, once a highly unstable country, which market-dollarized and got monetary stability after a severe currency crisis collapsed the riel to 4,000 to the US dollar and a coup, also has a 20 percent tax rate.

Hong Kong which has an orthodox style currency board has a corporate tax rate of 16.5 percent.

Hard pegged (dollarization is also a type of fixed exchange rate) countries have both lower income tax rates and also lower debt to GDP ratios (around 30 – 40 percent) due to their inability to run macro-economic policy and print money for growth. (Colombo/Jan29/2023)

[ad_2]

Source link