[ad_1]

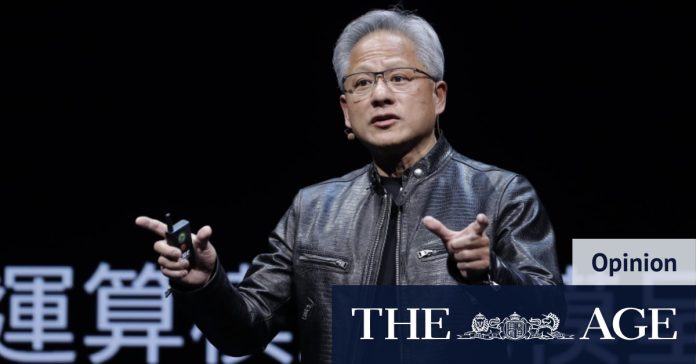

Huang recently declared AI was the beginning of the next industrial revolution and that Nvidia would turn data centres into AI factories.

There are a few other players in this market (AMD, Intel) and while their share prices have also been on a tear, there is daylight between Nvidia and the rest of the pack.

Demand for Nvidia’s top-of-the-line processors is far outstripping supply as Microsoft, Meta Platforms and Google parent Alphabet race to expand their AI computing capabilities and dominate the emerging technology.

The recent explosion in Nvidia’s share price – which increased its market capitalisation by more than $US1 trillion in six weeks – is what has investors’ heads swivelling.

Over those six weeks, Nvidia’s market capitalisation has grown by more than four times the market value of BHP.

The company more than doubled sales to US$61billion in the year that ended in January 2024. That number is poised to nearly double again to over US$110 billion by January 2025. That is an 11-fold increase in sales (along with gross margin expansion) compared with the numbers in 2020.

Loading

Such breathtaking speed has naturally drawn the ire of sceptics who suggest caution about Nvidia’s ability to continue expanding its business and its share price at warp speed. Overtaking Apple on the trillionaires chart will add more fuel to that fire, but can Nvidia really deliver a repeat performance as far as its share price is concerned?

Nvidia’s stock price necessitates sustained double-digit revenue growth off its new US$110 billion base – and this is certainly possible. But there are investors who suggest that Nvidia’s outsized share price returns would imply revenue growth even greater than double digits.

Nvidia’s stock is responsible for a third of the S&P500’s gains this year, but the question is whether maintaining this breakneck pace of growth is realistic.

Loading

Nvidia doesn’t trade in a vacuum. Its share price performance will be influenced by broader market sentiment. And this calendar year, that sentiment has gone in the share market’s favour – particularly for the “growth” technology stocks (that typically populate the US Nasdaq Index).

Nvidia is part of the Nasdaq and S&P500 index and has been a large contributor to the overall positive performance of both. So for now, it looks like the tail is wagging the dog with Nvidia calling the shots.

The Market Recap newsletter is a wrap of the day’s trading. Get it each weekday afternoon.

[ad_2]

Source link