[ad_1]

ECONOMYNEXT – The International Monetary Fund has advised the Maldives to operate monetary policy consistent with maintaining its currency peg with the US dollar, as the archipelago recovered strongly from Coronavirus pandemic.

In 2022 Maldives grew by 13.9 percent and in 2023 the country is estimated to grow by 4.4 percent. Growth is projected at 5.2 percent in 2024.

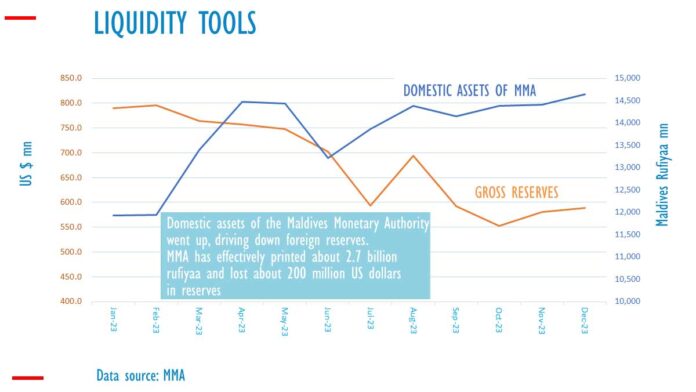

“Monetary and macroprudential policies need to be tightened to ensure compatibility with the exchange rate peg, while encompassing fiscal-monetary policy coordination,” an IMF statement said after annual Article IV consultations.

“Monetary policy, in concertation with other policy levers, can contribute more effectively to addressing macroeconomic vulnerabilities. Discontinuing use of the Maldives Monetary Authority (MMA) advances is a welcome first step.”

With a fairly hardened peg, though hit from time to time by overt central bank advances and still limited open market operations, the Maldives Monetary Authority is unable to generate mass poverty and hunger with steep currency depreciation like in Sri Lanka.

The peg had served as a fairly credible anchor for monetary stability, allowing FDI to flow in and boost the tourism sector.

Maldives grows and imports labour, including as housemaids from countries like Sri Lanka and some other South Asian countries with inflationist domestic operations and bad money.

In sharp contrast to the advice given to Maldives to hold back on liquidity injections to protect the currency, Sri Lanka is told to use ‘exchange rate as the first line of defence’ to maintain a bureaucratically decided narrow policy rate with liquidity injections, in a tail wagging the dog exercise, critics say.

Analysts and classical economists have called for meaningful monetary reform in Sri Lanka to limit liquidity injections so that macroeconomists cannot deploy aggressive policy to cut rates, destroy confidence and then trigger external crises followed by high corrective rates.

Sri Lanka recently passed an IMF backed monetary law – drawn up by the agency itself – giving itself sweeping discretion over exchange and monetary policy and to print money for growth, instead of financing the deficit, critics say.

The agency has also won the right to create up to 7 percent inflation.

The rupee has collapsed to 360 to the US dollar (under Governor Nandalal Weerasinghe it has been allowed to appreciate to 314 with deflationary policy), from 4.76 to the US dollar compared to only about 15 by the Maldives Monetary Authority over the same period.

Maldives however has had fiscal problems since a civil service pay hike in the latter stages of ex-President Maumoon Abdul Gayoom who served for many decades under a stable exchange rate peg.

Maldives has also borrowed excessively, including from China after the US loosened policy and flooded markets with dollars over the last 20 years, which led to a steep rise in national debt.

Under a fixed or mostly fixed exchange rate, the lenders are hurt by a default rather than the public who only will have to pay some additional taxes.

But if macro-economists are given the legal right to depreciate, (which essentially came after the Second Amendment to the IMF’s Articles) indiscriminate poverty is among the weakest in society without any useful benefit to the debt repayment process. (Colombo/Feb07/2024)

[ad_2]

Source link