[ad_1]

FTX says that nearly all of its customers will receive the money back that they are owed, two years after the cryptocurrency exchange imploded, and some will get more than that.

FTX said in a court filing that it owes about $US11.2 billion ($17 billion) it owes to more than two million customers and other non-governmental creditors. The exchange estimates that it has between $US14.5 billion and $US16.3 billion to distribute to them.

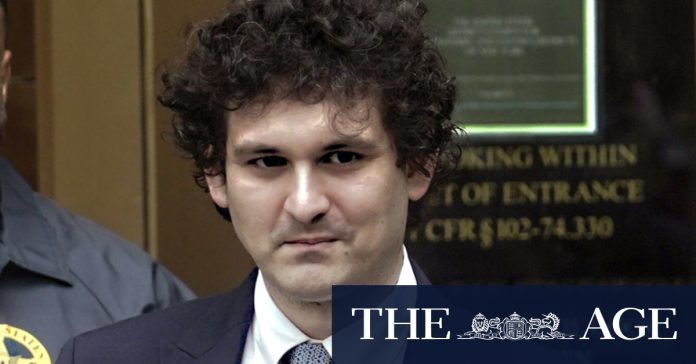

FTX founder Sam Bankman-Fried was jailed in March for 25 years.Credit: AP

The filing said that after paying claims in full, the plan provides for supplemental interest payments to creditors, to the extent that funds still remain. The interest rate for most creditors is 9 per cent.

That may be a diminished consolation for investors who were trading cryptocurrency on the exchange when it collapsed. When FTX sought bankruptcy protection in November 2022, Bitcoin was going for $US16,080. But crypto prices have soared as the economy recovered while the assets at FTX were sorted out over the past two years. A single Bitcoin on Tuesday was selling for close to $US62,675. That comes out to a 290 per cent loss, a bit less than that if accrued interest is counted, if those investors had held onto those coins.

Loading

Customers and creditors that claim $US50,000 or less will get about 118 per cent of their claim, according to the plan, which was filed with the US Bankruptcy Court for the District of Delaware. This covers about 98 per cent of FTX customers.

The latest figures underscore the surprising outcome for FTX, whose collapse drew comparisons to Enron Corp.’s fraud-fuelled downfall and the unravelling of Bernie Madoff’s Ponzi scheme. Earlier this year, the company had about $US6.4 billion in cash.

FTX said that it was able to recover funds by monetising a collection of assets that mostly consisted of proprietary investments held by the Alameda or FTX Ventures businesses, or litigation claims.

FTX was the third-largest cryptocurrency exchange in the world when it filed for bankruptcy protection in November 2022 after it experienced the crypto equivalent of a bank run.

[ad_2]

Source link