Chinese investment in Australian companies has hit a historic low, signaling a significant shift in global economic dynamics. The latest report by consultancy giant KPMG and the University of Sydney reveals a stark decline, with investment dropping by 36 percent to $1.3 billion in 2023, compared to $2.1 billion the previous year.

This downturn in Chinese investment extends across various sectors, with the mining industry experiencing a particularly sharp decrease from $1.8 billion in 2022 to just $34 million in 2023. The report attributes this decline to investor hesitancy, especially in critical minerals, amidst geopolitical tensions and uncertainties.

The primary reason behind this dwindling investment lies in China’s strategic realignment towards countries participating in its ambitious Belt and Road Initiative (BRI). For the first time, investments in BRI nations have surpassed 20 percent of China’s total overseas direct investment, underscoring the initiative’s growing significance in reshaping global economic landscapes.

Since its inception in 2013, the Belt and Road Initiative has been a cornerstone of Chinese President Xi Jinping’s vision for expanding China’s influence globally. By funneling massive investments into infrastructure projects spanning Asia, Latin America, Africa, and parts of Europe, China aims to bolster connectivity and enhance trade networks. However, the initiative has faced skepticism and pushback, particularly from Western nations wary of Beijing’s geopolitical motives and debt-trap diplomacy concerns.

Helen Zhi Dent, partner at KPMG Australia and co-author of the report, notes that Chinese investment in Australia in 2023 marked its lowest point since 2006. She emphasizes the shifting priorities of Chinese outbound direct investment (ODI), which is increasingly directed towards BRI countries and mining ventures in alternative markets like Southeast Asia.

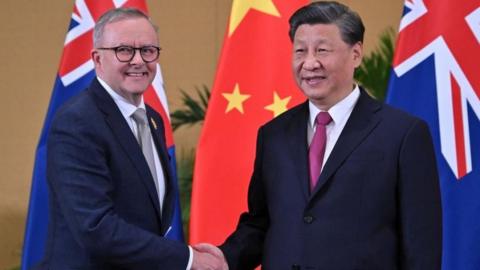

Despite the downturn, there is optimism for potential revival in Chinese investor interest in Australian businesses, driven by improving cross-border trade conditions. Recent developments, such as the removal of wine tariffs, indicate a positive trajectory for bilateral trade relations. Dent highlights industries with a history of mutual cooperation between Australian and Chinese businesses, such as resources, food and agribusiness, and renewables, as potential areas for renewed investment.

The decline in Chinese investment in Australia serves as a microcosm of broader geopolitical trends and strategic maneuvers. As China recalibrates its economic priorities towards the Belt and Road Initiative, traditional investment destinations like Australia are witnessing a reevaluation of their economic ties with the rising superpower. The ramifications of this shift extend beyond bilateral relations, impacting global trade dynamics and investment flows.

For Australia, navigating this evolving landscape requires a delicate balance between capitalizing on new opportunities and managing geopolitical risks. As Chinese investment trends continue to evolve, policymakers and businesses alike must adapt to the changing realities of the global economic order. Collaboration, innovation, and strategic foresight will be essential in charting a path forward amidst these dynamic geopolitical currents.