[ad_1]

The property sector started to stall after Beijing, worried about a housing bubble and its impact on the financial system, rolled out a series of rules in 2020 aimed at curbing the excessive borrowing of real estate developers. Without easy access to debt, developers struggled to pay off loans and finish building properties that were sold in advance to homebuyers.

Nomura Securities, a Japanese financial services firm, estimates that there are still 20 million units of presold homes waiting to be finished, which would require $US450 billion in funding to complete.

Now China has walked back many of those restrictions. Financial regulators are urging banks to lend more to property developers. Last week, Xiao Yuanqi, deputy director of China’s National Financial Regulatory Administration, said the country’s financial institutions had “an inescapable responsibility to provide strong support” to the property sector.

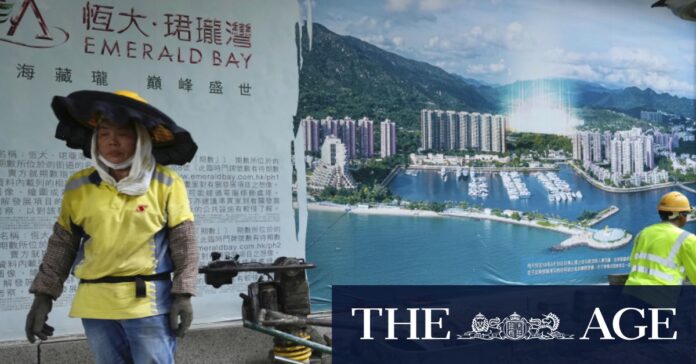

China’s property crisis is accelerating. Credit: Getty Images

Banks should not immediately cut off loans to troubled projects, but should find ways to support them by extending time to repay the loans or float additional funds, Xiao added. Last week, China’s central bank and finance regulator said that it would allow some developers to use bank loans for commercial properties to repay other loans or bonds.

Since 2021, more than 50 Chinese property firms have defaulted on debt, including the two firms that once dominated the country’s housing market: Evergrande and Country Garden. Once Evergrande’s main rival for industry leadership, Country Garden effectively defaulted in October. The company’s situation has worsened because its sales have collapsed.

Country Garden said presales of unfinished apartments, an important indicator of future revenue, fell for a ninth consecutive month in December, to 6.91 billion yuan ($1.48 billion). That was down 69 per cent from a year earlier. In the second half of 2023, presales were down 74 per cent from a year earlier.

Real estate accounts for roughly one-quarter of China’s economy.

In a research note this month, Larry Hu, chief China economist for Macquarie Group, said the property slump was “self-fulfilling,” because the debt woes of property developers kept buyers away and pressured home sales, while the dearth of new business only deepened the financial problems of those firms.

“The key thing to watch in 2024 is if and when the central government would step in and take the main responsibility to stop the contagion,” Hu wrote. He said Chinese authorities could bail out property developers, similar to how the US government stepped in during the global financial crisis with the Troubled Asset Relief Program, or TARP.

When China moved to cool real estate several years ago, one step it took was to limit speculators from buying homes. Homebuyers were required to make large down payments, discouraging people from buying additional properties.

Suzhou, a city in eastern China, lifted most of its home purchase restrictions, removing limits on the number of homes one person could purchase and waiving any residency requirements, state-run media reported Tuesday.

China Evergrande was finally put into liquidation this week. Credit: Bloomberg

But even easing the rules has not helped to lift the market. China’s outstanding mortgage loans fell 1.6 per cent last year over 2022, a year when businesses and residents in many cities were still contending with pandemic lockdowns. This, according to the Chinese business magazine Caixin, was the first decline in almost two decades. Mortgages had been growing by more than 10 per cent annually until 2021.

A lingering cause for concern for some potential homebuyers remains the large quantities of unfinished, presold apartments. For years, homebuyers would agree to purchase new apartments and start paying a mortgage years before the units were built. It caused an uproar when some property developers suspended construction on presold apartments because they lacked the funds to pay contractors and builders.

Loading

While the government has pushed firms to finish construction on presold apartments, there are still many projects that are not complete.

Nydia Duan, a 19-year-old college student in Zhuhai, in the southern province of Guangdong, said her family offered to buy her a home when she turned 18, but she resisted because she was concerned in part about buying an unfinished apartment.

While housing prices have plummeted in recent years, Duan said that she was generally pessimistic about the outlook for real estate, and that she preferred to keep her family’s money in cash.

“I’m still reluctant to buy one,” she said. “I’ll consider it when the property market is more stable.”

[ad_2]

Source link