The Central Bank of Sri Lanka sustained its trend of purchasing foreign exchange from the domestic banking system, acquiring US $245.3 million in January without selling any, signaling improved foreign currency liquidity and bolstering reserve levels as the country enters 2024.

The Central Bank of Sri Lanka maintained its proactive stance on bolstering foreign exchange reserves by purchasing US $245.3 million from the domestic banking system in January, reinforcing positive trends in foreign currency liquidity and reserve accumulation as the new year unfolds.

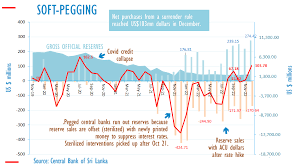

With no sales recorded during the month, the Central Bank’s net acquisition of foreign currency reflects an ongoing effort to strengthen reserve buffers amidst evolving economic conditions. The significant purchases contribute to a continued upward trajectory in reserve levels, which reached a record high of US $4.4 billion by the end of 2023, facilitated by substantial net absorptions throughout the year.

Building upon this momentum, reserves expanded further by nearly US $100 million to reach US $4,491.0 million by the end of January 2024, underscoring sustained efforts to fortify the country’s external financial position.

The robust reserve accumulation aligns with the Central Bank’s commitment to maintaining stability in the foreign exchange market and curbing excessive volatility in the exchange rate. Despite market dynamics driving appreciation pressures on the Sri Lankan rupee, the Central Bank’s intervention through dollar purchases serves to mitigate excessive fluctuations, ensuring a balanced exchange rate environment.

Furthermore, normalized tourism earnings and remittance inflows are expected to bolster the Central Bank’s ability to continue purchasing foreign currency, further augmenting reserve levels and meeting targets outlined under the International Monetary Fund program.

In a strategic move to enhance financial cooperation, reports indicate that the Central Bank has extended a yuan-denominated currency swap agreement with the People’s Bank of China, providing additional support to reserve management efforts. The extension, with a dollar equivalence of 1.4 billion, underscores collaborative efforts to bolster liquidity and stability in the foreign exchange market, fostering resilience in Sri Lanka’s economic landscape.