[ad_1]

The COVID-inspired rush to the regions is over, with two-thirds of Australia’s population growth in the next two decades to be concentrated in the big four cities of Sydney, Melbourne, Brisbane and Perth according to new research.

Exclusive forecasts by demographers consulting business, Informed Decisions (.id), reveal that the nation’s population is forecast to grow by 7.4 million by 2041, requiring an additional two million dwellings across our four major cities which will account for over 65% of the forecast population growth.

Following a five-year period of significant growth in regional areas, in part driven by COVID-19 and work-from-home trends, a re-opening of national borders is seeing a return of urban population growth that is forecast to continue for many years to come.

This return to cities is being driven by the availability of study and work opportunities, and higher concentrations of people at their family-forming stages of life in urban areas.

Key findings of the research:

- The four largest states will receive 93% of Australia’s forecast population growth by 2041, with the four capitals receiving 67% of that total growth.

- Victoria’s population is forecast to add 2.0 million with 1.6 million occurring in Greater Melbourne and requiring 723,000 additional dwellings.

- New South Wales population is forecast to add 1.7 million with 1.2 million occurring in Greater Sydney and requiring 582,000 additional dwellings.

- Queensland is forecast to add 1.6 million with 1.0 million occurring in Greater Brisbane and requiring 381,000 additional dwellings.

- Western Australia is forecast to be 0.9 million with 0.8 million occurring in Greater Perth and requiring 334,000 additional dwellings.

- Tasmania is forecast to face a demographic imbalance problem with young people once again leaving for the mainland and people in retirement age groups continuing to move to Tasmania.

- Sunshine Coast is forecast to triple its retirement-aged population over the next 25 years caused by a combination of migration from other regions/states and the current population ageing in place.

CEO of .id Lailani Burra said:

“What we found was that the regional growth we’ve seen over the past few years was caused by an interruption to regular programming.

Where these areas typically lose population – predominantly young people, to larger cities – COVID and university lockdowns have put a halt.

So most of the growth was not from people coming, but from people not leaving these regional areas.”

How is our infrastructure going to cope?

With the growth in the urban population returning and forecast to continue over the next 25 years it is important that there is sufficient capacity in our cities to accommodate this population growth both in terms of housing supply, and infrastructure and services needed to support well-integrated and socially mobile communities.

And it’s not just the hard infrastructure many think of such as transport and shops, but the soft infrastructure such as schools, hospitals and aged care facilities.

Ms Burra said:

“We often talk about population and housing challenges at the national, state or local government area level, but this work quantifies the impacts at the much more detailed suburbs/community/local area level.

Overseas migration will continue to have a significant impact on the future of Australia, but it won’t affect every community in the same way.”

What does this mean for you as a property investor?

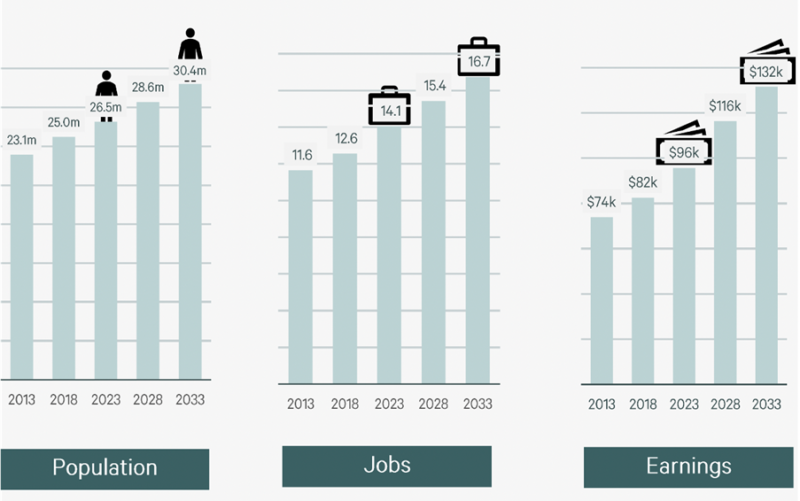

In the medium term, our property markets will be underpinned by 3 factors:

- A significantly growing population

- Strong jobs creation

- Increasing the wealth of our nation.

Putting all this together, I see the current market offering a window of opportunity for property investors with a long-term focus.

You see…we are at the beginning of a new property cycle, something that doesn’t happen very often.

Not that I suggest you try and time the market- this is just too difficult, and in truth, you’ve missed the bottom which occurred in early 2023.

But if the market hands you an opportunity like this why not take advantage of it?

Taking advantage of the upturn stage of a new property has created significant wealth for investors in the past.

Moving forward, demand is going to outstrip supply for some time to come as we experience record levels of immigration at a time when we’re not building anywhere as many properties as we require.

At the same time, the cost of construction of delivering new dwellings will keep increasing not only because of supply chain issues and the lack of sufficient skilled labour but also because builders and developers will only commence new projects if they are financially viable and currently new projects will need to come on line at considerably higher prices than the current market price,

Of course, in due course, consumer sentiment will rebound when it becomes clear that inflation continues to fall and interest rates have peaked.

At that time pent-up demand will be released as greed (FOMO) overtakes fear (FOBE – Fear of buying early), as it always does as the property cycle moves on.

We are also going to be experiencing a prolonged period of strong rental growth – the rental crisis will only worsen further, with no end in sight.

Now I’m not suggesting taking advantage of tenants, what I’m suggesting is to recognise there is currently a problem (lack of rental accommodation) and provide a solution.

So rather than trying to hunt down a bargain, focus on buying an investment-grade property in an A-grade location because these types of properties are in short supply but are still selling for reasonably good prices… Plus they’ll hold their value far better in the long term.

While it might feel counterintuitive to buy at a time when there are so many mixed messages in the media, you can benefit from less competition, low consumer sentiment, minimal downside risk and minimal risk of oversupply.

[ad_2]

Source link