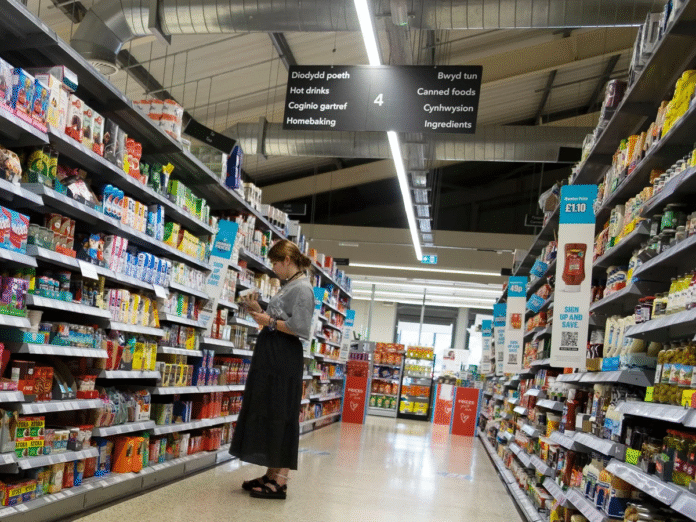

The United Kingdom’s inflation rate remained unchanged at 3.8% in September, defying forecasts of an increase, according to official figures released by the Office for National Statistics (ONS). The data showed food prices rising at their slowest pace in over a year, offering a modest sign of relief for consumers.

According to the ONS, the inflation rate for food and non-alcoholic drinks dropped from 5.1% in August to 4.5% in September — the first decline since May of the previous year. ONS Chief Economist Grant Fitzner noted that while prices remain “quite high,” the steady slowdown signals “a small glimmer of hope” for households struggling with high living costs.

The latest data also revealed that petrol prices and airfares were the largest upward contributors to inflation, as their rate of decline slowed compared to last year. However, these increases were largely balanced by falling prices in recreational and cultural activities, including live entertainment.

Despite the stable figure, inflation continues to hover well above the Bank of England’s 2% target. The Bank had expected inflation to rise to 4% in September, but the outcome fell short of projections.

Chancellor Rachel Reeves expressed dissatisfaction with the numbers, stating that “for too long, our economy has felt stuck,” and pledged to focus on easing cost-of-living pressures while promoting growth. Meanwhile, Shadow Chancellor Mel Stride criticized Labour’s handling of the economy, claiming that high inflation continues to “punish those Labour promised to protect.”

The September inflation rate is particularly significant as it serves as the benchmark for next April’s benefits increase. This means millions of people relying on government benefits are likely to see a 3.8% rise in payments next year. However, under the state pension’s triple lock policy, pensioners are expected to receive a higher increase of 4.8%, based on average wage growth.

Inflation in the UK, while significantly lower than the 40-year high of 11.1% in October 2022, remains persistently above the central bank’s target, reflecting ongoing challenges in achieving full price stability.