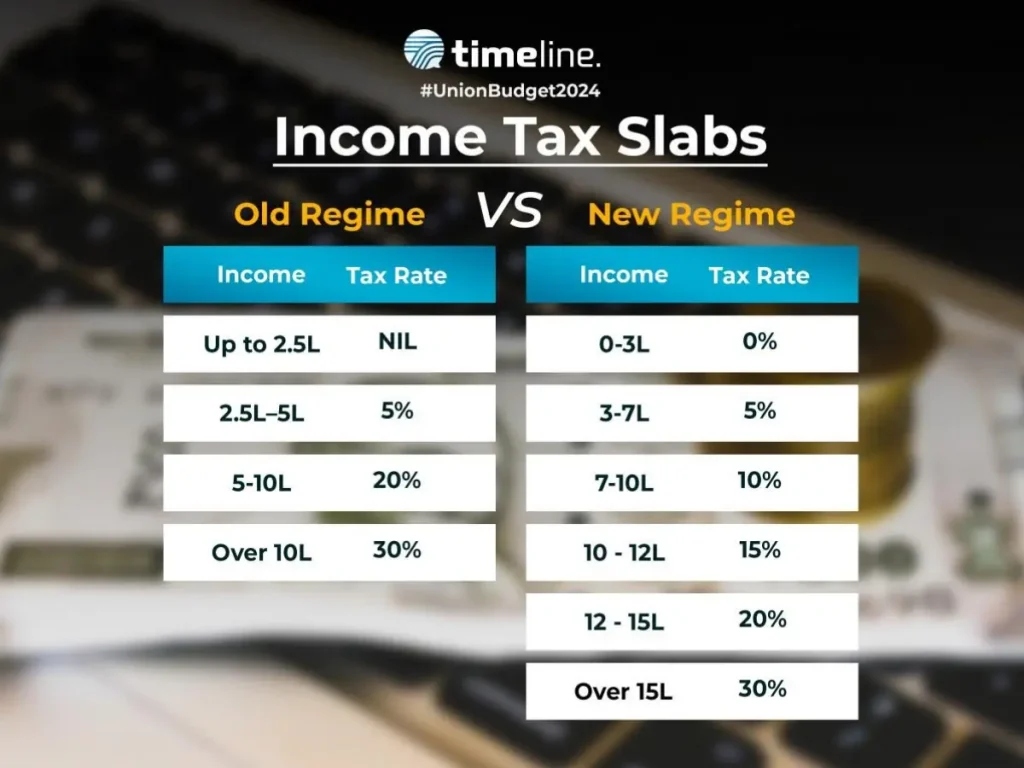

The Union Budget 2024-25 presented by Finance Minister Nirmala Sitharaman brings significant changes to the tax landscape, encouraging more individuals to adopt the simplified new tax regime. While this may benefit those in lower income slabs, high-income earners may find the old tax regime more advantageous in the long run.

In the new tax regime, the income tax slabs have been liberalized, and the standard deduction has been increased from ₹50,000 to ₹75,000. This move is designed to provide relief to salaried individuals, making the new regime appealing. However, for those claiming substantial deductions, such as up to ₹2 lakh on home loan interest or significant house rent allowance (HRA), the old tax regime remains more beneficial.

For instance, a salaried employee earning ₹11 lakh with deductions exceeding ₹3,93,750 would find the old regime more cost-effective. This scenario is also applicable to couples with a combined income who can claim such high deductions. Similarly, individuals with incomes around ₹60 lakh, who claim deductions over ₹3,93,750, will save more under the old regime. Conversely, for incomes up to ₹7.75 lakh, the new tax regime offers better benefits.

For high-income earners, especially those with incomes over ₹10 lakh, the old regime’s flexibility in deductions translates to more significant savings. On the other hand, the new regime, with its lower surcharge rate of 39%, is advantageous for individuals with substantially high incomes, such as ₹6 crore.

In summary, the choice between the old and new tax regimes depends largely on income levels and eligible deductions. High-income earners with significant deductions may prefer the old regime, while those with incomes up to ₹7 lakh and over ₹5-6 crore could benefit more from the new, simplified regime.

#Budget2024 #TaxRegime #IncomeTax #HighIncomeEarners #FinancialPlanning #TaxDeductions #NewTaxRegime