[ad_1]

ECONOMYNEXT – Sri Lanka’s main opposition Samagi Jana Balawegaya has welcomed a proposal for governance linked bonds but re-voiced objections to underlying securities linked to economic performance that are sought by sovereign bondholders in a re-structuring.

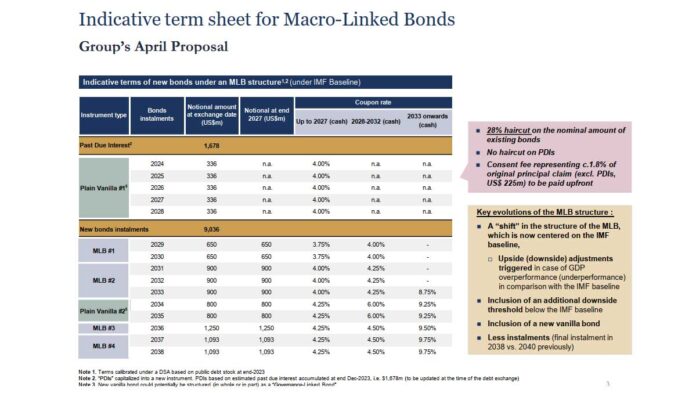

SJB said the bond holders clearly did not want to move away from macro-linked bonds, on a higher ‘alternative baseline’, based on the contents of a statement issued by the Finance Ministry after a first round of talks with bondholders in London.

RELATED Sri Lanka agrees to state contingent factor in ISB exchange, ESG bonds also in play

“The main problem with this approach from the point of view of Sri Lanka is with their proposed structure of sharing the upside,” opposition legislator Harsha de Silva, the economic spokesman of the SJB said in a statement.

“It is not acceptable given the pain already incurred and will be incurred for decades to come by domestic creditors forced upon by the domestic debt restructure.”

Sri Lanka has already re-structured bonds in pension funds without haircuts, by extending maturities.

In an apparent softening of their earlier stance the SJB said it was “possible to discuss” a value recovery instrument separate from the underlying bond, to give upside.

“We do understand the need for some type of value recovery instrument (VRI) that could be a component of the final restructured series,” de Silva said.

“[B]ut we are of the opinion that to link the same to every bond takes away the freedom of a future government to manage the nation’s liabilities in the most beneficial way for Sri Lanka. It is possible to discuss the VRI structure that is detachable from the main instrument.”

Bondholders however have come to dislike the VRIs on the basis that they cannot hold them as warrants are not index eligible. As a result, bondholders say they are forced to sell VRIs to hedge funds at low initial prices.

In the end, the benefit of any upside will not go to the ‘real money’ investors who may have bought bonds at par at issue, took haircuts and coupon cuts, but to third party hedge funds.

Many emerging market sovereign bonds are illiquid and bondholders themselves may be contributing to losing ‘market access’ by selling in panic, critics say.

A case in point was Ecuador, which is dollarized after its currency collapsed to 25,000 some years ago and the inflationists can no longer conduct ‘macro-economic policy’ and destroy the currency or create big crises but lost market access in the Covid crisis.

According to a statement released by the Finance Ministry, Sri Lanka has agreed to bonds linked to economic performance, but did not agree to the triggers or the quantum of payments to be made under various scenarios.

De Silva, who is also chairs the parliament’s Committee on Public Enterprises, earlier requested meeting with ‘relevant stakeholders’ but the government had instead scheduled a meeting with an IMF team, de Silva said.

“…[W]e note with disappointments that there has been absolutely no transparency in the government’s debt restructuring process even though we had requested for same,” de Silva said.

The talks themselves are held under non-disclosure agreements.

The full statement is reproduced below:

Response to press release 16 April 2024

These initial comments are based on the first reading of the press release by the Finance Ministry moments ago. We reserve the right to make additional comments upon in depth study of the proposals in the attachments.

At the outset, we note with disappointments that there has been absolutely no transparency in the government’s debt restructuring process even though we had requested for same.

In fact I personally requested for a meeting with the relevant stakeholders both as the economics spokesperson for the main opposition SJB and as the Chairman of the COPF.

That opportunity was not provided, instead a meeting with government officials was arranged to discuss the IMF program which we had no reason to attend as we anyway meet the delegation during their visits and exchange views on same.

From the press note it is obvious that the government has failed to strike a deal favorable to the people of Sri Lanka. We acknowledge however, that it is better to withdraw from the discussions than to agree to a bad deal.

Having said that, the statement by the head of Hon Presidents staff that the two sides agreed on two of the four issues is not accurate when the note categorically states that no agreement had been reached, only that they ‘came closer to meeting of minds’ if a significant additional payment was made and even then, contingent upon the government side agreeing to the bondholders remaining conditions.

It is clear that the participating bond holders do not want to move away from the original macro linked bond (MLB) structure they proposed based on the performance of the Sri Lanka economy to be measured on their much higher ‘alternative baseline’ as opposed to that of the IMF.

The main problem with this approach from the point of view of Sri Lanka is with their proposed structure of sharing the upside. It is not acceptable given the pain already incurred and will be incurred for decades to come by domestic creditors forced upon by the domestic debt restructure. It is now clear the alterative restructuring proposal by the government consisting of a mix of plain vanilla and MLB has been rejected by the bond holders.

We do understand the need for some type of value recovery instrument (VRI) that could be a component of the final restructured series, but we are of the opinion that to link the same to every bond takes away the freedom of a future government to manage the nation’s liabilities in the most beneficial way for Sri Lanka. It is possible to discuss the VRI structure that is detachable from the main instrument.

We are happy to note the inclusion of a discussion on a possible governance linked bond (GLB) structure and would be interested in discussing how that can be worked in to a possible instrument to be agreed upon.

We urge the government to be much more transparent in this restructuring process given that elections are around the corner and that the next government and those to come will be held responsible to honor the conditions agreed upon by this government on its final months. We are fully aware that any unilateral suspension of meeting any of the agreed payments would mean a second default which would be an absolute disaster. (Colombo/Apr16/2024)

[ad_2]

Source link