[ad_1]

ECONOMYNEXT- Sri Lanka will use cash deposits at state banks to settle part of bond auctions if the government felt that bid yields were too high, Central Bank Governor Nandalal Weerasinghe said.

At the last bond auction the debt office rejected about 60 percent of bonds at a 250 billion rupee bond auction, leading to speculation about the settlement means.

Related Sri Lanka sells only 29-pct of Rs250bn bond auction

“The government has built up this buffer, for them to be able to manage the short-term debt service payment,” Governor Weerasinghe told reporters Friday.

“Without relying on the two state banks overdraft facility, instead they have deposits now. That I think is a good development.”

The central bank is now not expected to print money directly to repay maturing debt and suppress rates as in the past, which triggers forex shortages.

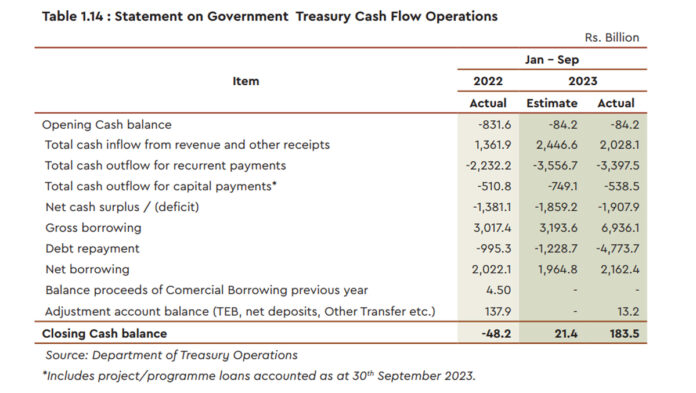

According to the mid-year fiscal report, the end September Treasury cash balance was 183.5 billion rupees, a steep correction from last year.

Until 2023, Sri Lanka has run large overdrafts of around 200 – 300 billion rupees, as well as arrears to suppliers.

Governor Weerasinghe said the general practice was to announce government cash needs transparently to the market through weekly bill auctions and bond auctions, ahead of time.

“The market knows that. The information that the market did not have is that the government has a buffer,” Governor Weerasinghe said.

“There was information that the central bank cannot intervene. I think that had been factored into the pricing without knowing that the government has a buffer.

” Now I would like to say that the government has this mechanism and a buffer. They also should know that there is a buffer. On that basis they can bid. That is why I think that will help stabilize government yield rates going forward, with that flexibility.”

“No one can in advance announce that this amount will be used,” he said, responding to a question whether information could be released about the volume of the cash that could be used, so that market participants would bid lower than they would otherwise have.

The central bank is raising debt for the government as an agency function.

“That depends on the day’s auction rate, what is the cut-off rate, what is the funding requirement, what is the size of the buffer, how long that buffer is going to be used.

“That flexibility is there now for the government to determine at what rate they are willing to borrow and the ability to reject if they think the rates are too high.”

[ad_2]

Source link